Chinese regulator mulls replenishing small, medium-sized banks amid rising non-performing loans ratio

An official from China’s banking regulator said Friday that China will strike a balance between maintaining steady growth and mitigating risks. The regulator will ensure that real estate financing is managed stable and in an orderly manner, and support local governments in ensuring the delivery of housing while protecting the public good.

“On the premise of maintaining the overall stability of the economy, we should dispose of risks in an orderly manner, prudently defuse risks linked to small- and medium-sized financial institutions, support local governments in issuing special bonds, replenish capital of small- and medium-sized banks, and actively cope with the rebound of non-performing assets,” said Zhou Liang, vice chairman of the China Banking and Insurance Regulatory Commission (CBIRC), on Friday at the 2022 China International Finance Annual Forum.

Zhou stressed the importance of ensuring stable financing in the property market to promote the delivery of housing to buyers and thus promote the steady and healthy development of the real estate market.

Optimizing risk monitoring and disposal mechanisms for large enterprises should also be guaranteed, Zhou said.

The vice chairman also disclosed that China’s financial risks have gradually shifted from divergence to convergence, and a number of major risks have been accurately addressed.

China has handled a whopping 12 trillion yuan ($1.7 trillion) of non-performing loans (NPLs) over the past five years, more than the total of non-performing loans handled in the previous 12 years.

The ratio of NPLs, especially those related to real estate, has increased among A-share listed banks, financial results showed.

On the whole, the proportion of housing loans of all gross loans decreased, while the ratio of NPLs to total gross loans for housing enterprises and individual housing loans both rose, which has become a common phenomenon in the banking industry.

Among the 23 banks that announced the ratio of NPLs to personal housing loans, China Merchants Bank reported a drop of 0.01 percentage points from the end of last year, while all other 22 banks saw an increase.

Analysts said that the increasing ratio of NPLs to total gross loans in major banks also reflected the serious situation facing the property market in China in the first half of 2022.

Among the 23 banks measured, the NPL ratio of personal housing loan in 22 banks were less than 1 percent in the first half of 2022, while Bank of Zhengzhou was the only one with a ratio exceeding 1 percent, reaching 1.34 percent, up 0.38 percentage points from the end of 2021.

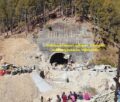

Most stalled housing projects are located in Central China’s Henan, Hunan and Hubei provinces. Henan province has 35 paused projects with Zhengzhou, the capital city, home to 26.

But in absolute terms, the risks in the property market are manageable, analysts noted.

The State Council last week released 19 measures to stabilize economy, among which is one allowing for a city-tailored approach to using credit to underpin inelastic housing demand and homeowners eyeing a shift toward bigger and nicer homes.

— report from Global Times

-

Book Shelf

-

Book Review

DESTINY OF A DYSFUNCTIONAL NUCLEAR STATE

Book Review

DESTINY OF A DYSFUNCTIONAL NUCLEAR STATE

- Book ReviewChina FO Presser Where is the fountainhead of jihad?

- Book ReviewNews Pak Syndrome bedevils Indo-Bangla ties

- Book Review Understanding Vedic Equality….: Book Review

- Book Review Buddhism Made Easy: Book Review

- Book ReviewNews Elegant Summary Of Krishnamurti’s teachings

- Book Review Review: Perspectives: The Timeless Way of Wisdom

- Book ReviewNews Rituals too a world of Rhythm

- Book Review Marx After Marxism

- Book Review John Updike’s Terrorist – a review

-

-

Recent Top Post

-

NewsTop Story

What Would “Total Victory” Mean in Gaza?

NewsTop Story

What Would “Total Victory” Mean in Gaza?

-

CommentariesTop Story

The Occupation of Territory in War

CommentariesTop Story

The Occupation of Territory in War

-

CommentariesTop Story

Pakistan: Infighting in ruling elite intensifies following shock election result

CommentariesTop Story

Pakistan: Infighting in ruling elite intensifies following shock election result

-

CommentariesTop Story

Proforma Polls in Pakistan Today

CommentariesTop Story

Proforma Polls in Pakistan Today

-

CommentariesTop Story

Global South Dithering Away from BRI

CommentariesTop Story

Global South Dithering Away from BRI

-

News

Meherabad beckons….

News

Meherabad beckons….

-

CommentariesTop Story

Hong Kong court liquidates failed Chinese property giant

CommentariesTop Story

Hong Kong court liquidates failed Chinese property giant

-

CommentariesTop Story

China’s stock market fall sounds alarm bells

CommentariesTop Story

China’s stock market fall sounds alarm bells

-

Commentaries

Middle East: Opportunity for the US

Commentaries

Middle East: Opportunity for the US

-

Commentaries

India – Maldives Relations Nosedive

Commentaries

India – Maldives Relations Nosedive

-

AdSense code