China Q2 growth disappoints, youth unemployment hits record 21.3%

BEIJING – China’s economy grew at a frail pace in the second quarter as demand weakens at home and abroad, with post-Covid-19 momentum faltering rapidly and raising pressure on policymakers to deliver more stimulus to shore up activity.

Unemployment among Chinese youth jumped to a record 21.3 per cent in June, data from the National Bureau of Statistics (NBS) also showed.

Overall urban unemployment remained at 5.2 per cent, the NBS said in a statement.

The Chinese authorities face a daunting task in trying to keep the economic recovery on track and putting a lid on unemployment, as any aggressive stimulus could fuel debt risks and structural distortions.

On a year-on-year basis, gross domestic product (GDP) expanded 6.3 per cent in the second quarter, accelerating from 4.5 per cent in the first three months of the year, but the rate was below the forecast for growth of 7.3 per cent.

The annual pace was the quickest since the second quarter of 2021, but the reading was heavily skewed by economic pains caused by stringent Covid-19 lockdowns in Shanghai and other major Chinese cities in 2022.

“The data suggests that China’s post-Covid boom is clearly over,” said Ms Carol Kong, economist at Commonwealth Bank of Australia in Sydney.

“The higher-frequency indicators are up from May’s numbers, but still paint a picture of a bleak and faltering recovery and at the same time youth unemployment is hitting record highs.”

Indeed, recent data showed a rapidly faltering post-Covid-19 recovery as exports fell the most in three years owing to cooling demand at home and abroad, while a prolonged downturn in the key property market has sapped confidence. The weak overall momentum has raised expectations that policymakers will need to do more to shore up the world’s second-biggest economy.

The authorities are likely to roll out more stimulus steps, including fiscal spending to fund big-ticket infrastructure projects, more support for consumers and private companies, and some property policy easing, policy insiders and economists said. But analysts say a quick turnaround is unlikely.

All eyes are on an expected Politburo meeting later in July, when top leaders could chart the policy course for the rest of the year.

Urgent policy support?

While China is seen to be on track to hit its modest 2023 growth target of around 5 per cent, some analysts say there are risks of the goal being missed.

“It was quite a disappointing number at just 6.3 per cent, so clearly the momentum is slowing down,” said Mr Alvin Tan, head of Asia forex strategy at RBC Capital Markets in Singapore.

“At this pace of deceleration, there’s now actually a risk that the growth target may not be achieved – this 5 per cent may not be achieved if the economy continues to decelerate at this pace. So I think this does raise greater urgency for more policy support soon.”

Most analysts say policymakers are likely to dole out modest supportive measures instead of embracing any aggressive stimulus because of limited room and worries of growing debt risks.

However, a deeper slowdown could stoke more job losses and fuel deflationary risks, further undermining private-sector confidence, they said.

A senior central bank official said on Friday that the bank will use policy tools such as the reserve requirement ratio and medium-term lending facility to weather economic challenges.

In June, the central bank cut its benchmark lending rates by a modest 10 basis points.

For June alone, China’s retail sales grew 3.1 per cent, slowing sharply from a 12.7 per cent jump in May, the data showed. Analysts had expected growth of 3.2 per cent.

Industrial output growth unexpectedly quickened to 4.4 per cent in June from 3.5 per cent in May, but demand remains lukewarm amid the bumpy economic recovery.

Some economists have blamed the “scarring effects” caused by years of strict Covid-19 measures and regulatory curbs on the property and technology sectors – despite recent official efforts to reverse some curbs to support the economy.

With uncertainty running high, cautious households and private businesses are building up their savings and paying off their debts rather than making new purchases or investments.

—From The Strait Times, July 17, 2023

https://www.straitstimes.com/business/china-q2-gdp-disappoints-youth-unemployment-hits-record-213

-

Book Shelf

-

Book Review

DESTINY OF A DYSFUNCTIONAL NUCLEAR STATE

Book Review

DESTINY OF A DYSFUNCTIONAL NUCLEAR STATE

- Book ReviewChina FO Presser Where is the fountainhead of jihad?

- Book ReviewNews Pak Syndrome bedevils Indo-Bangla ties

- Book Review Understanding Vedic Equality….: Book Review

- Book Review Buddhism Made Easy: Book Review

- Book ReviewNews Elegant Summary Of Krishnamurti’s teachings

- Book Review Review: Perspectives: The Timeless Way of Wisdom

- Book ReviewNews Rituals too a world of Rhythm

- Book Review Marx After Marxism

- Book Review John Updike’s Terrorist – a review

-

-

Recent Top Post

-

Commentaries

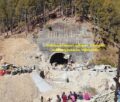

Impasse over BRI Projects in Nepal

Commentaries

Impasse over BRI Projects in Nepal

-

CommentariesNews

Yet another Musical Chairs in Kathmandu

CommentariesNews

Yet another Musical Chairs in Kathmandu

-

CommentariesTop Story

Spurt in Anti-India Activities in Canada

CommentariesTop Story

Spurt in Anti-India Activities in Canada

-

NewsTop Story

Nepal: Political Stability Under Threat Again

NewsTop Story

Nepal: Political Stability Under Threat Again

-

NewsTop Story

Accountability Tryst With 2024 Ballot….

NewsTop Story

Accountability Tryst With 2024 Ballot….

-

NewsTop Story

What Would “Total Victory” Mean in Gaza?

NewsTop Story

What Would “Total Victory” Mean in Gaza?

-

CommentariesTop Story

The Occupation of Territory in War

CommentariesTop Story

The Occupation of Territory in War

-

CommentariesTop Story

Pakistan: Infighting in ruling elite intensifies following shock election result

CommentariesTop Story

Pakistan: Infighting in ruling elite intensifies following shock election result

-

CommentariesTop Story

Proforma Polls in Pakistan Today

CommentariesTop Story

Proforma Polls in Pakistan Today

-

CommentariesTop Story

Global South Dithering Away from BRI

CommentariesTop Story

Global South Dithering Away from BRI

-

AdSense code