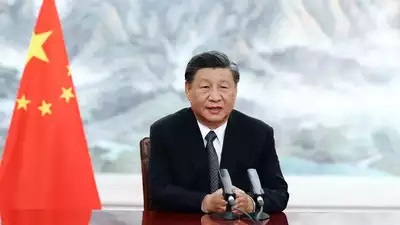

Beijing ‘fine-tuning’ economic data

China is the second largest economy in the world, but the official economic data are often “fine-tuned” due to political factors, making it more difficult for foreign economists to predict China’s actual economic situation, according to the British “Financial Times”.

The National Bureau of Statistics of China recently announced that the GDP (gross domestic product) growth rate in the second quarter increased by 0.8% compared with the first quarter and 6.3% compared with the same period last year.

The reason for this gap is that China’s National Bureau of Statistics makes “seasonal adjustments” to the quarterly growth figures for 2022. While such corrections are routine, analysts say the impact has grown larger in recent years.

The lack of any detailed explanation for the process underscores how difficult it is to parse China’s statistics at a time when the trajectory of the country’s economy is seen as critical to global growth.

“This is where we are right now,” said Louis Kuijs, chief Asia economist at S&P Global. “How much did China’s economy grow in the second quarter, or did it not? This is a very important question for markets and policymakers. Everyone is asking, ‘Is the Chinese economy stalling?’ It’s not easy to give a clean answer to that.”

Shehzad Qazi, chief operating officer of China Beige Book International (CBBI), said that China has undoubtedly become more of a black box and has been moving in this direction. The firm publishes alternative economic indicators based on surveys of private Chinese companies that consistently show private consumption in China is weaker than official data suggest.

There has been a new sense of urgency about how to interpret China’s economic indicators this year, as official Chinese data showed that the country had lost economic momentum after the lifting of anti-epidemic measures. Policymakers are grappling with economic headwinds, sluggish consumption and a near two-year crunch in real estate funding.

Like many countries, China’s official data is often used as a “reference” and can be supplemented with other indicators ranging from steel production capacity to energy consumption. But while Chinese officials have added a host of other new data, they have stopped providing many of them without giving clear reasons, making it more difficult to obtain supplementary and detailed information.

Diana Choyleva, chief economist at Endo Economics in London, said: “The disappearance of a series of economic data from China has always been part of the overall challenge of analyzing the state of the Chinese economy, but over the past few years, it has definitely become more difficult to obtain reliable data.”

Under the zero-clearing policy, the outside world has more doubts about the reliability of China’s economic data. In the absence of clear messages from local governments, traffic data has been turned into an indicator of the severity of urban lockdowns; the Chinese government has stopped releasing figures on deaths from the virus after a nationwide outbreak. The Zhejiang provincial government released data on the surge in cremations earlier this month and later deleted it.

Carlos Casanova, senior Asia economist at UBP, said he was unable to access data on local government land sales at Wind, a Chinese data database, because foreign use of the platform had been limited this year, “probably because of pressure”.

As the Chinese government tightens its grip on information, including passing new data laws that in many cases require multinational companies to separate their domestic and foreign data, fewer and fewer organizations are providing any data.

“When the CBBI first started, we had a lot of competitors, most of which have disappeared,” said Qazi, who testified on Chinese economic data before the U.S. House of Representatives’ ad hoc committee on U.S.-China competition this month.

- from Liberty Times, July 23, 2023

-

Book Shelf

-

Book Review

DESTINY OF A DYSFUNCTIONAL NUCLEAR STATE

Book Review

DESTINY OF A DYSFUNCTIONAL NUCLEAR STATE

- Book ReviewChina FO Presser Where is the fountainhead of jihad?

- Book ReviewNews Pak Syndrome bedevils Indo-Bangla ties

- Book Review Understanding Vedic Equality….: Book Review

- Book Review Buddhism Made Easy: Book Review

- Book ReviewNews Elegant Summary Of Krishnamurti’s teachings

- Book Review Review: Perspectives: The Timeless Way of Wisdom

- Book ReviewNews Rituals too a world of Rhythm

- Book Review Marx After Marxism

- Book Review John Updike’s Terrorist – a review

-

-

Recent Top Post

-

NewsTop Story

What Would “Total Victory” Mean in Gaza?

NewsTop Story

What Would “Total Victory” Mean in Gaza?

-

CommentariesTop Story

The Occupation of Territory in War

CommentariesTop Story

The Occupation of Territory in War

-

CommentariesTop Story

Pakistan: Infighting in ruling elite intensifies following shock election result

CommentariesTop Story

Pakistan: Infighting in ruling elite intensifies following shock election result

-

CommentariesTop Story

Proforma Polls in Pakistan Today

CommentariesTop Story

Proforma Polls in Pakistan Today

-

CommentariesTop Story

Global South Dithering Away from BRI

CommentariesTop Story

Global South Dithering Away from BRI

-

News

Meherabad beckons….

News

Meherabad beckons….

-

CommentariesTop Story

Hong Kong court liquidates failed Chinese property giant

CommentariesTop Story

Hong Kong court liquidates failed Chinese property giant

-

CommentariesTop Story

China’s stock market fall sounds alarm bells

CommentariesTop Story

China’s stock market fall sounds alarm bells

-

Commentaries

Middle East: Opportunity for the US

Commentaries

Middle East: Opportunity for the US

-

Commentaries

India – Maldives Relations Nosedive

Commentaries

India – Maldives Relations Nosedive

-

AdSense code