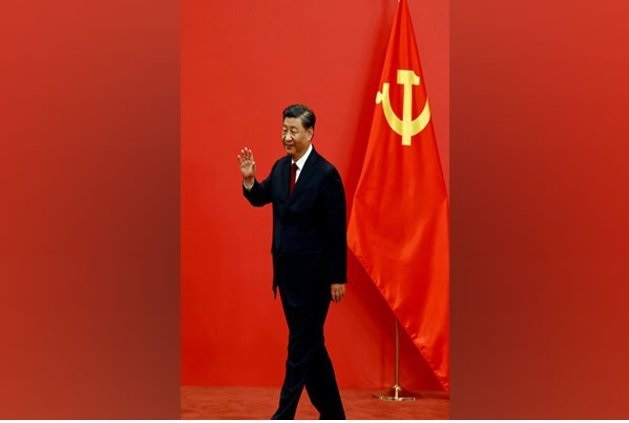

China’s Xi to battle rising debt, economic woes and political rivals at congress

Ruling Chinese Communist Party leader Xi Jinping will be looking to eliminate high-profile rivals and other influential figures from the political scene, while taking a firmer grip of the country’s purse-strings at the forthcoming National People’s Congress annual session in Beijing, analysts told Radio Free Asia in recent interviews.

Xi is widely expected to announce thorough-going political restructuring that will give him still more concentrated power over the daily affairs of the country, including the downgrading of the State Council in favor of special committees controlled by the highest echelons of party leaders in Beijing.

He also presides over a flagging economy, a massive hole in public finances following three years of the zero-COVID policy and flatlining business confidence, amid an ongoing crackdown on private companies and prominent members of the financial elite.

Plans are underway to hive off the ministries of public security and state security from the government hierarchy, and run their portfolios under a party Central Internal Affairs Commission similar to the structure used by Moscow in the days of the Soviet Union, Hong Kong’s Ming Pao newspaper reported recently.

Other State Council functions could also migrate to direct party control, including the departments in charge of Hong Kong and Macau, and of managing ties with democratic Taiwan.

Independent political commentator Cai Shenkun said much of the expected restructuring, public details of which will likely emerge at the National People’s Congress, will be aimed at ensuring that no effective or popular political figure can rise to challenge Xi’s personal power and influence.

“Downgrading the State Council would actually make it impossible for anyone to rise to a place of prominence from within its ranks,” Cai said.

He said Xi may have succeeded in stacking the ruling party’s Politburo and its all-powerful, seven-member standing committee with officials loyal to him, but he still has a nagging worry that one of them could become powerful enough to bring him down.

“He won’t be totally trusting of those people, even of someone as loyal to him as Li Qiang,” Cai said, in a reference to the Politburo standing committee member widely expected to be made premier at the forthcoming National People’s Congress.

“This may now become the norm for China’s political structure, going forward.”

Financial challenges ahead

U.S.-based journalist Deng Yuwen, a former editor of Communist Party school publication, said Xi is likely more focused on gearing up for financial challenges, however.

“He has been in power for a long time now, so there isn’t anyone who could challenge his position,” Deng said. “Given the current environment, his top priority will be ensuring that certain problems don’t arise, such as in the financial sector.”

Deng said Xi had already taken much of the State Council’s power for himself during his last five-year term in office, taking the responsibility for running the economy away from his premier Li Keqiang, in a break with decades of collective leadership at the top of the party.

“The State Council is just an administrative department now,” Deng said, although he said Li Keqiang did have a seat on Xi’s powerful committees governing financial and economic affairs as well as state reforms, and that he expects that to continue under Li Qiang.

Scott Kennedy, senior adviser at the Center for Strategic and International Studies in Washington, said there are concerns that Xi is moving away from the tendency in recent decades to appoint economic technocrats to run the economy.

“For the last 30-plus years, China’s economic performance has depended on very smart, wise, economic bureaucrats who have [been] given political space to implement a whole variety of economic policies that are pragmatic,” Kennedy said.

“There’s a worry that this era is coming to an end, certainly because of the overall direction and trajectory Xi Jinping wants to take the country, his emphasis on political loyalty above expertise,” he said.

He said the officials currently heading the central bank, banking regulators and security market regulars are all scheduled for retirement or redeployment, with their more powerful political mentors also expected to step down at this parliament.

“Their replacements, who have not been named yet, may understand math, but they may not understand economies, and they may understand who their boss is even more,” Kennedy said. “The economy looks really problematic – short term and long term.”

Jude Blanchette, who holds the Freeman Chair in China Studies at the same institution, said Xi will likely build on the significant restructuring he began at the 2018 National People’s Congress.

“We saw significant transfer of power vertically from the State Council up into the Communist Party,” Blanchette said. “So we saw party organizations take over roles that had previously been held by state council ministries and bureaucracies. “

Mounting debt burden

He said Xi has a tendency to elevate party-led “working groups,” which used to play a coordinating role within the party hierarchy, to the status of commissions, or ministries, in a significant expansion of their power.

“The indications are that the reform plan that’s going to be announced this year will be, roughly, equal in its importance,” he said.

Cai agreed that the financial sector is going to be a key priority for Xi, noting the recent detention of China Renaissance private banker Bao Fan, who is “assisting the authorities with an investigation,” according to a company notice filed with the Hong Kong Stock Exchange.

“Xi Jinping wants to set up a new Central Financial Work Committee,” he said. “It may be that he thinks that Li Qiang isn’t up to the job of cleaning up the financial system, or that Xi has reservations about him.”

Official figures released ahead of the National People’s Congress showed that China’s public revenue totaled more than 20 trillion yuan last year, while expenditure topped 26 trillion yuan, an increase of 6.1% on the previous year, finance minister Liu Kun told a March 1 news conference in Beijing.

Cai said he estimates that around one third of public expenditure last year went on the rolling lockdowns, mass quarantines and compulsory daily COVID-19 testing programs of Xi’s zero-COVID policy.

The policy has left local governments struggling with an ever-mounting debt burden, prompting officials to borrow more to pay back old debts, and to raid the coffers of medical insurance funds to make ends meet, resulting in cuts to medical benefits and mass protests in major cities last month.

“Local governments and officials were forced into borrowing desperately so as to lock down their cities, without regard to cost,” Cai said. “Local officials were fired … in Guangdong … for failing to implement the zero-COVID restrictions.”

“According to my understanding, a lot of local governments have been dipping into medical insurance funds, so they have been unable to make normal payouts for medical insurance as in previous years,” he said. “This year’s medical insurance reforms were fueled in large part by the fact that much of that funding has been leached away.”

Costly pandemic policies

Finance minister Liu Kun warned on March 1 that the government would continue to insist that party and government officials “keep a tight rein” on their finances.

Hu Jianjun, a resident of a small city in the eastern province of Shandong, said the zero-COVID policy had sparked a huge amount of waste.

“A lot of money was wasted,” Hu said. “For example, in my residential community, where one of the leaders is a friend of mine, that small community was spending 500,000 yuan a day just on pandemic restrictions.”

“Communities in bigger cities spent even more frightening amounts.”

Bloomberg cited official data in a Feb. 27 report as saying that at least 17 of China’s 31 provinces and municipalities are facing severe fiscal deficits, with local borrowing exceeding 120% of income, which the ministry of finance set as a “warning level” for local government debt in 2020.

Xie Tian, ??a professor at the Aiken School of Business at the University of South Carolina, said 10 provinces currently have a debt-to-income ratio of more than 200%, with one running at more than 300%.

U.S.-based economist Li Hengqing said local governments have also had to deal with increased tax reductions, exemptions and early tax refunds, while the ongoing downturn in the real estate industry has led to a sharp drop in land transfer fees, which once accounted for 40% of local fiscal revenues.

“Every tax rebate is a form of expenditure, which is made to maintain the overall economy and to comply with requirements from the central government,” Li said.

“The other cost is the pandemic, with local governments bearing most of the costs of pandemic restrictions, especially where it relates to local organization and the hiring of personnel like pandemic prevention staff and police and community workers who maintained order,” he said.

But he said there is currently little scope to boost government finances through overall economic growth.

“There isn’t much likelihood of an economic recovery in China, which means there isn’t much likelihood that local governments will be able to pay back their debts, either,” he said.

—-RFA report, March 4, 2023

(Copyright © 1998-2020, RFA)

https://www.rfa.org/english/news/china/npc-xijinping-03032023135721.html

-

Book Shelf

-

Book Review

DESTINY OF A DYSFUNCTIONAL NUCLEAR STATE

Book Review

DESTINY OF A DYSFUNCTIONAL NUCLEAR STATE

- Book ReviewChina FO Presser Where is the fountainhead of jihad?

- Book ReviewNews Pak Syndrome bedevils Indo-Bangla ties

- Book Review Understanding Vedic Equality….: Book Review

- Book Review Buddhism Made Easy: Book Review

- Book ReviewNews Elegant Summary Of Krishnamurti’s teachings

- Book Review Review: Perspectives: The Timeless Way of Wisdom

- Book ReviewNews Rituals too a world of Rhythm

- Book Review Marx After Marxism

- Book Review John Updike’s Terrorist – a review

-

-

Recent Top Post

-

NewsTop Story

What Would “Total Victory” Mean in Gaza?

NewsTop Story

What Would “Total Victory” Mean in Gaza?

-

CommentariesTop Story

The Occupation of Territory in War

CommentariesTop Story

The Occupation of Territory in War

-

CommentariesTop Story

Pakistan: Infighting in ruling elite intensifies following shock election result

CommentariesTop Story

Pakistan: Infighting in ruling elite intensifies following shock election result

-

CommentariesTop Story

Proforma Polls in Pakistan Today

CommentariesTop Story

Proforma Polls in Pakistan Today

-

CommentariesTop Story

Global South Dithering Away from BRI

CommentariesTop Story

Global South Dithering Away from BRI

-

News

Meherabad beckons….

News

Meherabad beckons….

-

CommentariesTop Story

Hong Kong court liquidates failed Chinese property giant

CommentariesTop Story

Hong Kong court liquidates failed Chinese property giant

-

CommentariesTop Story

China’s stock market fall sounds alarm bells

CommentariesTop Story

China’s stock market fall sounds alarm bells

-

Commentaries

Middle East: Opportunity for the US

Commentaries

Middle East: Opportunity for the US

-

Commentaries

India – Maldives Relations Nosedive

Commentaries

India – Maldives Relations Nosedive

-

AdSense code